Break-Even Point Calculator Tutorial

Launching a side-hustle—from handmade crafts to virtual consulting—can feel like uncharted waters. How do you know when you’ll actually turn a profit? Our free break-even point calculator transforms guesswork into data. Plug in your fixed costs, price per unit (or hourly rate), and variable cost per unit to instantly see the exact number of sales or service hours required to cover expenses. This in-depth tutorial walks you through why break-even analysis matters, how to use the calculator step by step, annotated screenshots, real-world examples, pro tips, and FAQs.

Why Break-Even Analysis Matters

- Set Sales Targets: Know exactly how many units or hours to sell to avoid losses.

- Price Strategically: Ensure your price covers fixed and variable costs with profit margin.

- Manage Cash Flow: Forecast revenue milestones and plan for upcoming expenses.

- Build Credibility: Present concrete numbers to partners, investors, or lenders.

How the Calculator Works

It uses this formula:

Break-Even Units = Fixed Costs ÷ (Price per Unit − Variable Cost per Unit)

- Fixed Costs: Rent, subscriptions, insurance, marketing retainers.

- Variable Cost per Unit: Materials, shipping, transaction fees.

- Price per Unit: What you charge per item or service hour.

Step-By-Step Tutorial

Click the CTA below to open the live calculator, then follow along with these screenshots.

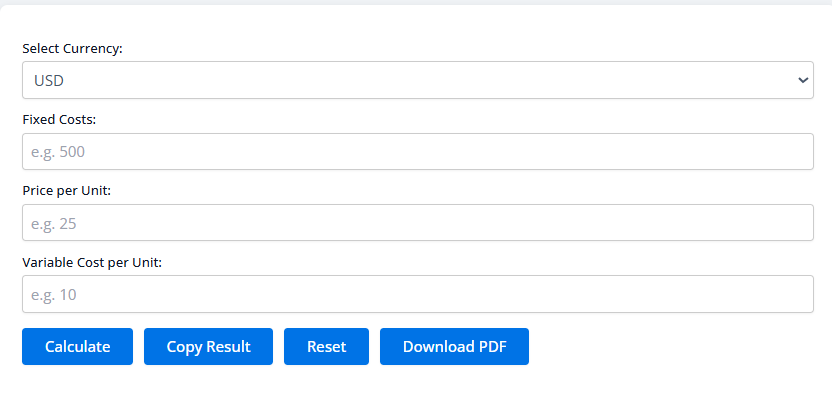

Try the Break-Even Calculator →- Select your currency: USD, CAD, GBP, or AUD.

- Enter total fixed costs for the period (monthly or quarterly).

- Type in your price per unit or hourly rate.

- Input variable cost per unit (materials, fees, etc.).

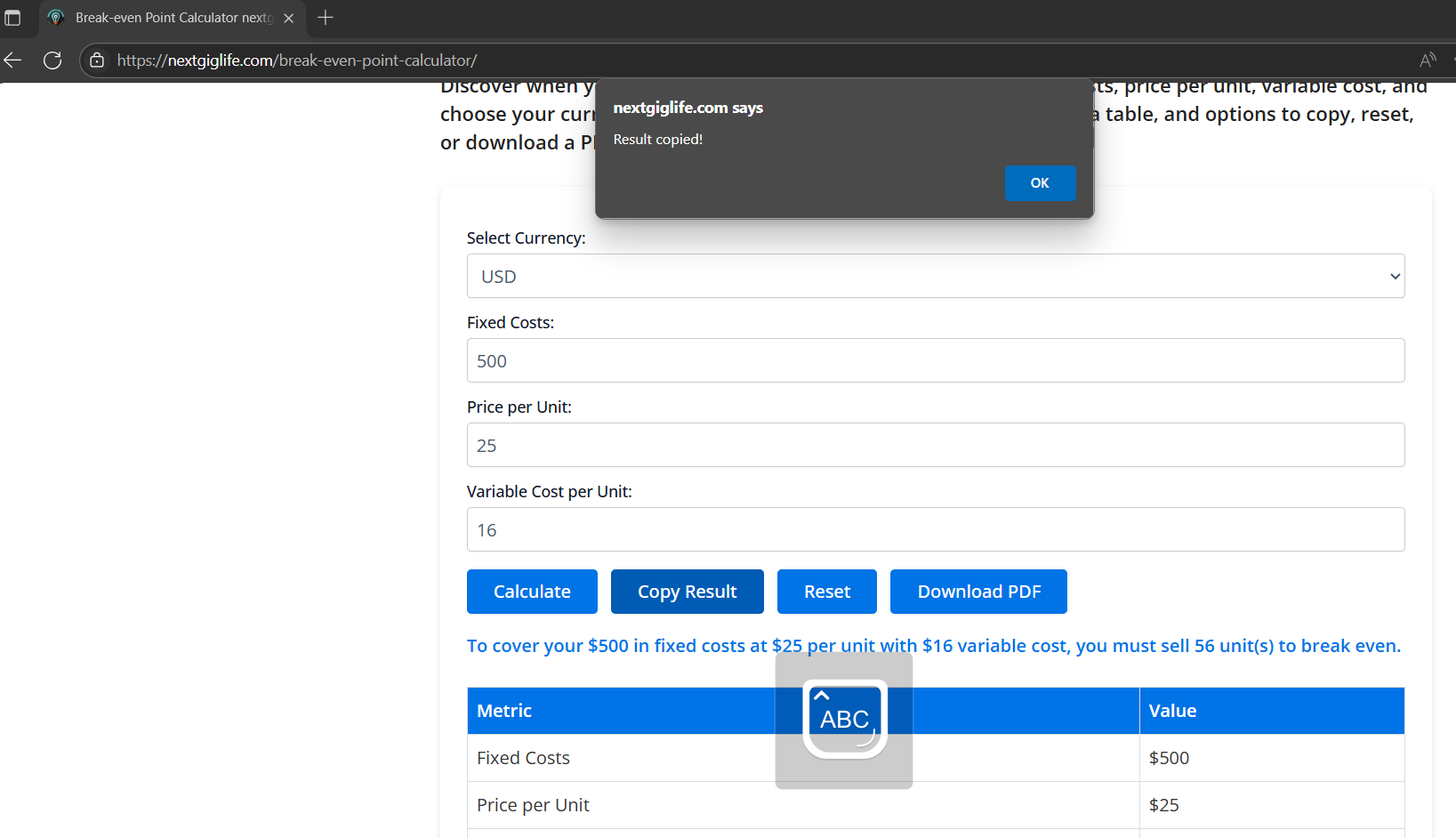

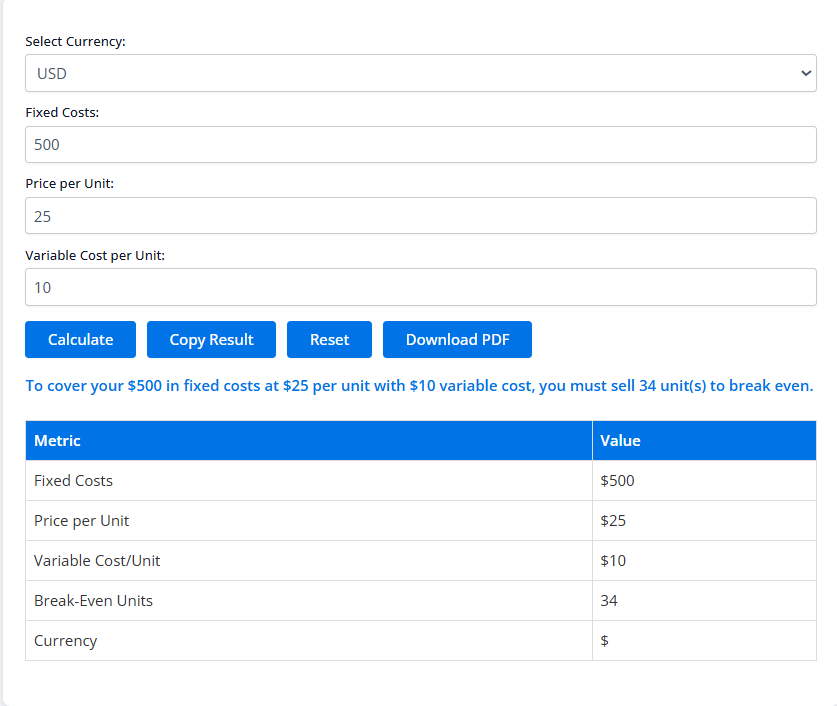

- Click Calculate to see break-even units and explanation.

- Use Copy to copy results or Download PDF to save a report.

Real-World Examples & What-If Scenarios

- Example 1: $600 fixed, $30 price, $15 variable → 40 units

- Example 2: CAD$1,200 fixed, CAD$50 price, CAD$20 variable → 40 units

- Example 3: £800 fixed, £80 price, £60 variable → 40 units

Adjust inputs in the live calculator to run “what-if” tests—see immediately how cutting costs or raising prices shifts your break-even point.

Pro Tips to Boost Profit

- Negotiate bulk discounts to lower variable costs.

- Create tiered pricing or bundles to increase average order value.

- Automate and consolidate subscriptions to reduce fixed expenses.

- Outsource non-core tasks to lower-cost freelancers.

- Revisit the calculator monthly to adapt to changing costs.

Frequently Asked Questions

Why is break-even analysis important?

It pinpoints when total revenue equals total cost, so every sale beyond that point contributes to profit.

Can I use this for service-based gigs?

Yes—treat your hourly rate as price per unit and your per-hour expenses as variable cost.

What if I don’t know all fixed costs?

Start with tracked recurring expenses—rent, utilities, software—and update as your budget refines.

Is the break-even point exact?

Mathematically yes, but round up your unit count to ensure full cost coverage and a small buffer.

Conclusion

Understanding your break-even point is crucial for side-hustle success. Use our free break-even point calculator to eliminate guesswork, set smart targets, and drive sustainable growth. Bookmark the tool and recalculate whenever your costs or pricing change.

Calculate Your Break-Even Point Now →